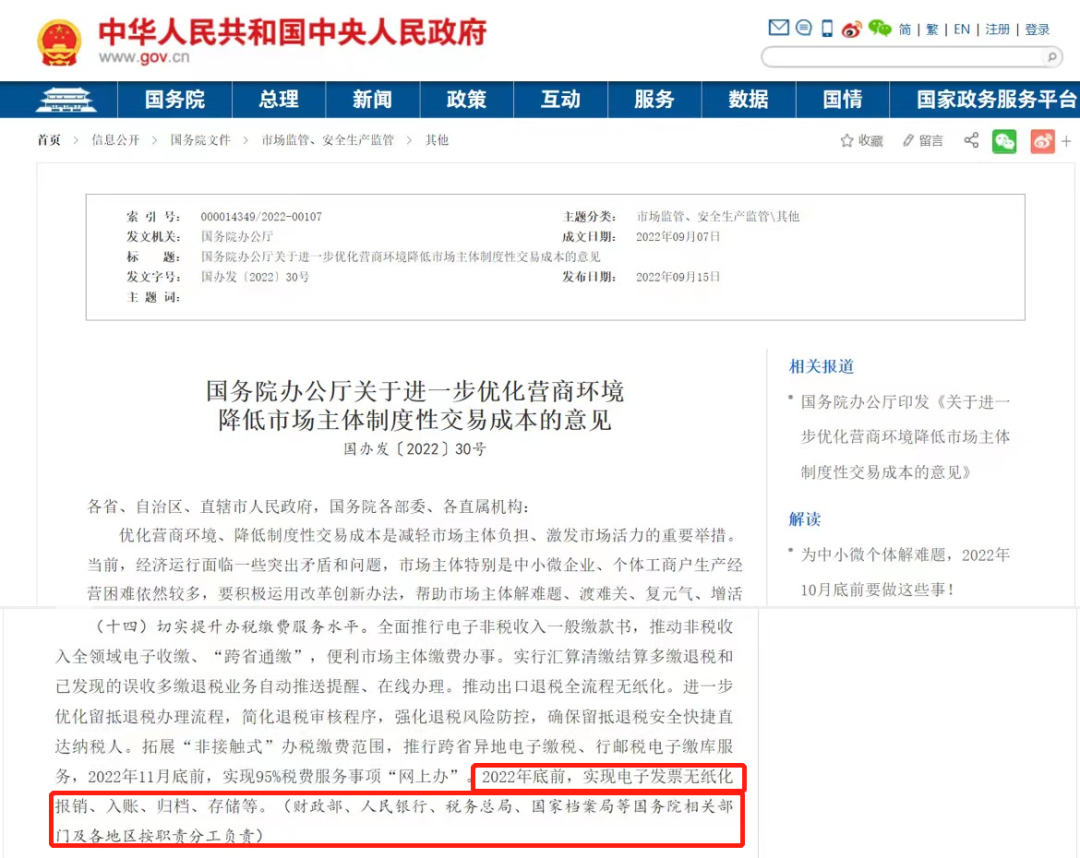

Recently, the General Office of the State

Council issued the "Opinions of the General Office of the State Council on

Further Optimizing the Business Environment and Reducing the Institutional

Transaction Costs of Market Entities" (Guo Ban Fa [2022] No. 30), which

clearly requires the implementation of paperless reimbursement, recording,

archiving, storage, etc. of electronic invoices by the end of 2022, and is the

responsibility of relevant departments of the State Council and regions such as

the Ministry of Finance, the People's Bank of China, the State Administration

of Taxation, and the National Archives Bureau according to their respective

responsibilities, Effectively improve the level of tax and payment services,

reduce institutional transaction costs for market entities, and optimize the

tax and business environment.

电子发票与会计档案电子化的发展历程:

全面实现电子发票无纸化报销、入账、归档、存储,即除法律、行政法规另有规定外,电子发票档案可不再以纸质形式保存,带来的直接影响是根本上解决纸电发票重复归档问题,大幅降低耗材、仓储等成本,财务工作更经济,更环保;通过重构并优化会计档案管理流程,实现电子归档单轨制,大幅降低人工成本,整体上节约企业运营成本,实现降本增效目标,增强纳税人获得感,符合我国新发展理念中的“绿色发展”要求。

发票完全无纸化时代的到来,给企业财务管理体系带来新的变化与挑战,要求企业:

全面实现电子发票无纸化报销、入账、归档、存储,积极推进“电子归档单轨制”,需要建立完善的电子会计资料管理制度,构建电子会计档案管理系统等工具,妥善保管电子会计资料原件。

企业要重视财税信息化建设需要,以新政策为契机,逐步实现报销入账归档全面电子化。根据华政近年来为多个大型集团提供的全税种信息化咨询服务经验,建议企业构建与现有系统相配套的标准、自动、协同、共享的新型税务管理信息系统,与业务系统、报销系统等对接,建立全量发票池,实现电子发票信息全方位监控;打破数据壁垒,有序衔接“业、财、税”系统,实现税款自动计算和申报;合理设计风险指标,用活平台各类数据汇总和分析功能,提升税务风险管理能力;并将企业内外部档案数据(含税务系统)采集到统一电子档案系统中,建立智能化关联,实现财务能力的集中与共享,促进财务转型。

华政作为行业内领先的服务机构,拥有专门的信息化建设团队,可提供企业智慧税务系统建设咨询、企业税务管理信息系统建设咨询、税务共享中心建设咨询、发票池建设与供应链优化咨询研发全流程管理系统建设咨询、AI税务风险扫描系统建设等系统实施咨询服务,协助企业开展税务数字化建设,从效率到智能,变革税务管理方式,实现“以数治税”。

-

Set Sail for the Sea, With Tax Benefits - Analysis of the Types of VAT Export Refund (Exemption) and Key Points of Declaration Practice

2024-10-22read:602second

-

Enterprise Must Read! The New Policy of Water Resource Tax Reform Has Been Introduced, And This Article Summarizes the Key Points of Policy Changes

2024-10-22read:598second

-

The 'Crime' and 'Punishment' of Tax Violations: A Must-Read Guide for Financial and Tax Personnel

2024-09-12read:651second

This website uses cookies to ensure you get the best experience on our website.