Mr. Wu, Xiaoqiang, Director of Hargent International Partners, was invited to deliver a training session on "Government-Social Capital Cooperation (PPP): China's Experience" to government officials from the Ministry of Finance and other relevant ministries on taxation policies in support of the PPP model On 29 November 2021.

The course was jointly organised by the Asia Pacific Finance and Development Institute (AFDI) of the Ministry of Finance of China and the Economic Finance Institute (EFI) of the Ministry of Finance of Cambodia, with the aim of introducing the achievements and experiences of China in the development of the PPP model in recent years to government officials from the Ministry of Finance of Cambodia and other relevant ministries. The participants were mainly Cambodian government officials, approximately 50 people attending the training online.

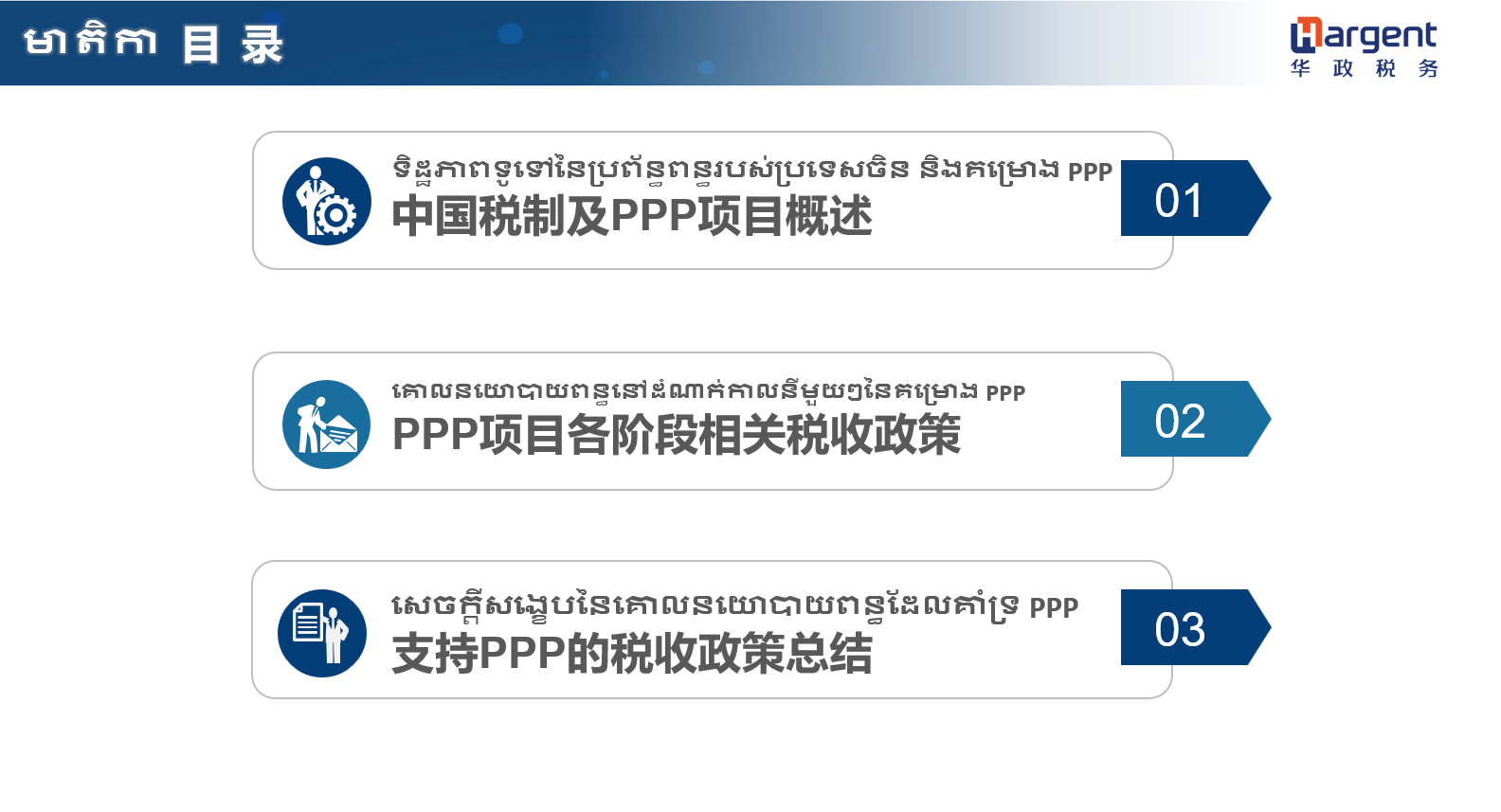

In this training, Mr. Wu,Xiaoqiang focused on three aspects: overview of China's tax system and PPP projects, relevant tax policies in various stages of PPP projects, and summary of tax policies supporting PPP.

Firstly, Mr. Wu,Xiaoqiang gave an overview of China's tax system, including the tax elements and legislation of various tax types such as corporate income tax and VAT, as well as the definition of PPP in China's legal environment, the classification of types, the main parties involved in PPP and various types of basic contractual relationships.

Secondly, Mr. Wu, Xiaoqiang analyzed in detail the common tax-related matters, relevant tax policies and tax treatment in each stage of PPP projects from four stages that are preliminary stage, construction stage, operation stage and handover stage, and gave a concise and clear explanation on various main issues, such as the main body of the project, project financing, selection of tax calculation method, application of tax rate, land acquisition and demolition, general subcontracting, pre-payment and pre-sub-tax, tax incentives, government subsidies, asset types and transfer of ownership.

Finally, Mr. Wu, Xiaoqiang summarised the various tax policies that support the development of PPP in China.

This training session presented a relatively well-established and regulated system of tax law for the Cambodian government as well as the policy system in promoting the development of PPPs, which will help the mutual exchange, learning and proliferation of financial and taxation policies among the international community of "Belt and Road Initiative.

Asia-Pacific Finance and Development Institute(AFDI):

The Asia-Pacific Finance and Development Institute (APFDI) was renamed in 2014 by the Asia-Pacific Finance and Development Centre (APFDC), formerly the Executive Secretariat of the APEC Finance and Development Project (AFDP), which was established in February 2002 as an APEC initiative activity initiated by China in 2001 under the APEC Finance Ministers' Meeting mechanism, with the aim of organising training, organising forums and conducting research and other forms. It aims to promote institutional capacity building of APEC economies in the financial and development sectors through various activities such as training, forums and research. Recent years, AFDC has played an active role in enhancing mutual trust and understanding among APEC member economies by organising training, forums, seminars and conducting research and other capacity building activities around topical issues of common concern to APEC member economies in the areas of finance and development.

Economics and Finance Institute(EFI)

The Institute is an important financial research and training institution in Cambodia that is part of the Cambodian Ministry of Finance. It has a Finance Training Unit and an Economic Research and Development Unit, which provide financial training for Cambodian finance officials, practitioners and other experts.

-

Organization of R&D Investment Fiscal and Taxation Management Training by China Metallurgical Group Co., Ltd

2022-07-20read:1148second

-

Hargent Provides Tax Policies Training “Public-Private-Partnership” (ppp) for Cambodian Government Expert

2021-11-29read:1375second

-

Hargent Provides International Specific Tax Training for Minmetals Development Corporation

2021-11-19read:1243second

Beijing Hargent Tax agent Office2021-11-29

This website uses cookies to ensure you get the best experience on our website.